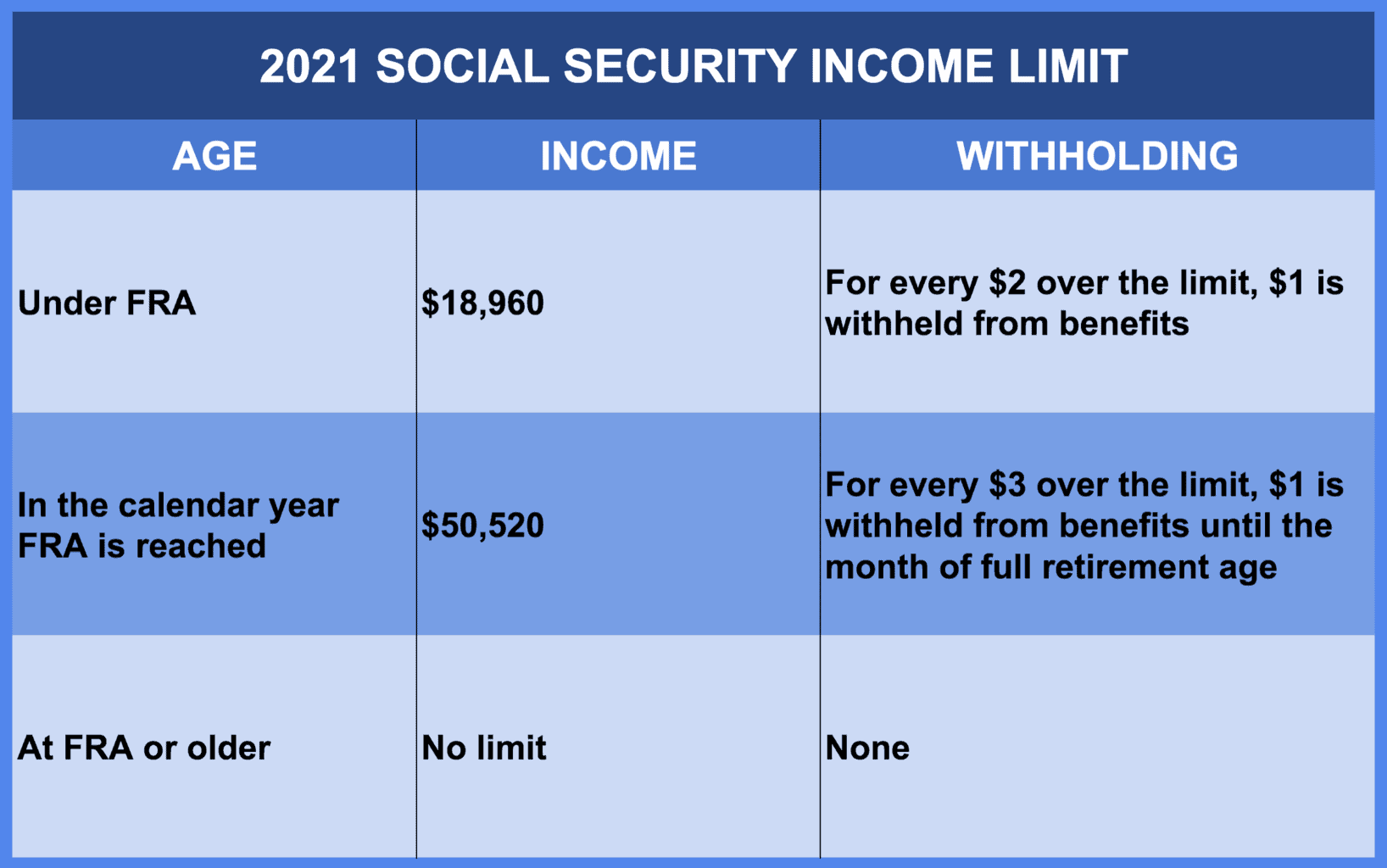

Social Security Tax Earnings Limit 2025. 50% of anything you earn over the cap. This limit changes each year with changes in the national average wage index.

The earnings limit for people reaching their “full” retirement age in 2025 will increase to $59,520. This amount is also commonly referred to.

Limit For Maximum Social Security Tax 2025 Financial Samurai, But that limit is rising in 2025, which means seniors who are working and. That's nearly a 45% pay cut from the $4,873 maximum for someone with the right salary.

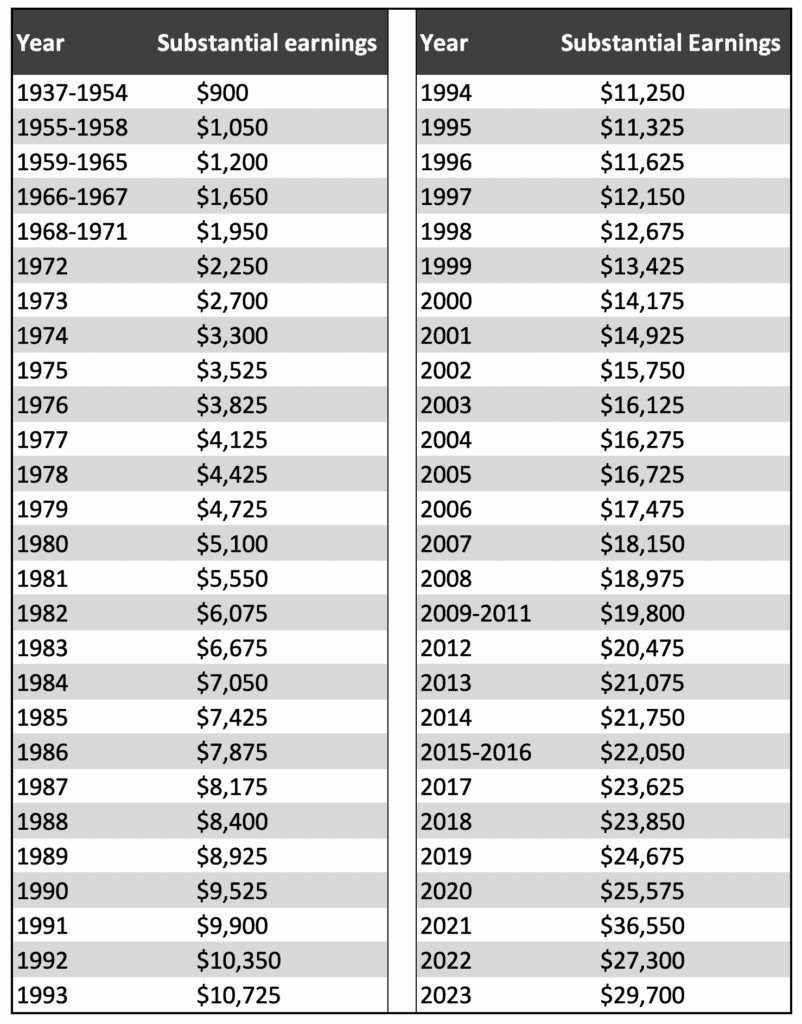

What Is Social Security Earnings Limit For 2025 Britt Colleen, If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial.

2025 Limit Social Security Intelligence, We raise this amount yearly to keep pace with increases in average. In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

2025 Social Security Limit YouTube, This amount is known as the “maximum taxable earnings” and changes. The absolute maximum social security benefit in 2025 is $4,873 monthly,.

Social Security Maximum Taxable Earnings 2025 2025 DRT, A new tax season has arrived. Earnings up to the limit become part of a worker's earnings record.

Maximum Taxable Amount For Social Security Tax (FICA), This amount is known as the maximum. The federal government of the united states always sets a social security tax limit 2025 on how much your income is subject to the social security tax for a.

Social Security Taxable Calculator Top FAQs of Tax Oct2022, Earnings up to the limit become part of a worker's earnings record. In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

How To Calculate, Find Social Security Tax Withholding Social, Use these rates and thresholds when you operate your payroll or provide. 50% of anything you earn over the cap.

Calculating Social Security Taxable, Earnings up to the limit become part of a worker's earnings record. Irs reminds taxpayers their social security benefits may be taxable | internal revenue service.

Taxable Rates 2025 For Social Security, This amount is known as the maximum. Up to 85% of your social security benefits are taxable if:

In 2025, the maximum earnings subject to social security payroll taxes will rise to $168,600 from $160,200.

Social Security Tax Earnings Limit 2025. 50% of anything you earn over the cap. This limit changes each year with changes in the national average wage index. The earnings limit for people reaching their “full” retirement age in 2025 will increase to $59,520. This amount is also commonly referred to. A New Tax Season Has…