Michigan Eitc 2025. 13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of. Taxpayers who qualify for michigan's newly expanded earned income tax credit (eitc) will start receiving checks in the mail for their 2025 tax.

While the changes apply only to the federal eitc, michigan taxpayers may also earn a larger state eitc since it is calculated at 6% of the federal credit. Beginning february 13, 2025, michigan will mail checks to families who qualified for the working families tax credit as part of their 2025 tax return.

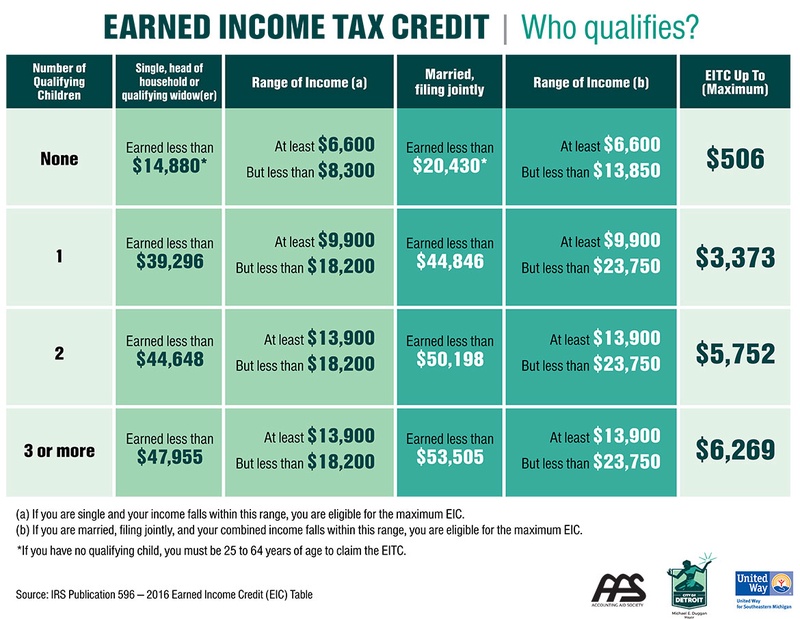

To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and.

IRS STIMULUS CHECK UPDATE NEW Tax Refund 1232 for EITC, Child Tax, The michigan tax credit is similar to the federal earned income tax credit (federal eitc). Gretchen whitmer announced her support for increasing the michigan earned income tax credit.

Press Michigan Senate Democrats, Public act 4 of 2025 expanded the michigan eitc from 6% of the federal. To get the eitc for the 2025 tax year (for tax returns filed in early 2025), your income has to be below the following levels:

EITC TAX CREDIT 2025 EARNED TAX CREDIT CALCULATOR 2025 YouTube, Taxpayers who qualify for michigan's newly expanded earned income tax credit (eitc) will start receiving checks in the mail for their 2025 tax. Federal eitc(earned income tax credits) rates and thresholds in 2025.

Powering Michigan's Future EITC IBEW NECA YouTube, 13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of. The checks, averaging about $550, are.

On EITC Awareness Day, Senate Democrats Celebrate FiveTime Increase of, $56,838 ($63,398 if married filing jointly) with. Beginning february 13, 2025, the michigan will mail checks to families who qualified for the working.

The Ultimate Guide to Help You Calculate the Earned Credit EIC, 13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of. Public act 4 of 2025 expanded the michigan eitc from 6% of the federal.

2025 Tax Bracket Changes and IRS Annual Inflation Adjustments, Public act 4 of 2025 expanded the michigan eitc from 6% of the federal. 13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of their 2025 tax.

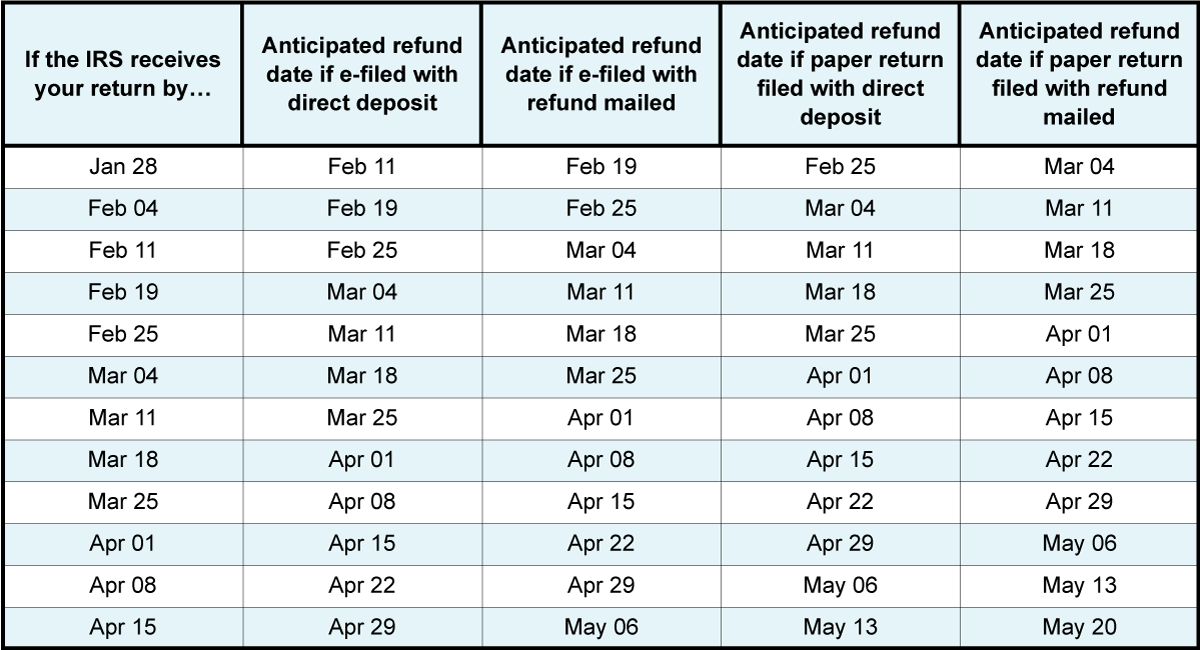

Irs Refund Calendar 2025 2025 Calendar Printable, 13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of. While the changes apply only to the federal eitc, michigan taxpayers may also earn a larger state eitc since it is calculated at 6% of the federal credit.

Regina Weiss Michigan House Democrats, 13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of their 2025 tax. The michigan earned income tax credit for working families (michigan eitc) provides a tax credit up to $2,080 for tax year 2025 and $2,229.

Michigan incrementó el Crédito Tributario Por ingreso del Trabajo (EITC, The earned income tax credit (eitc) is a significant tax credit in the united. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and.

13, 2025, the whitmer administration will mail checks to michigan families who qualify for the working families tax credit as part of.